Source Google.com.pk

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them ("covering"). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out. Historically, short selling is going against the upward trend of the stock market. In the USA, the S&P 500 index has realized an average yearly gain of approximately 9.77% return between 1926 and 2011.

Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.

In practical terms, going short can be considered the opposite of the conventional practice of "going long", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being "long") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.

measuring a small distance from end to end.

"short dark hair"

synonyms: small, little, tiny, minuscule; More

Some hold that the practice was invented in 1609 by Dutch merchant Isaac Le Maire, a sizeable shareholder of the Vereenigde Oostindische Compagnie (VOC).[4] Short selling can exert downward pressure on the underlying stock, driving down the price of shares of that security. This, combined with the seemingly complex and hard to follow tactics of the practice, have made short selling a historical target for criticism.[5] At various times in history, governments have restricted or banned short selling.

The London banking house of Neal, James, Fordyce and Down collapsed in June 1772, precipitating a major crisis which included the collapse of almost every private bank in Scotland, and a liquidity crisis in the two major banking centres of the world, London and Amsterdam. The bank had been speculating by shorting East India Company stock on a massive scale, and apparently using customer deposits to cover losses. It was perceived[citation needed] as having a magnifying effect in the violent downturn in the Dutch tulip market in the eighteenth century. In another well-referenced example, George Soros became notorious for "breaking the Bank of England" on Black Wednesday of 1992, when he sold short more than $10 billion worth of pounds sterling.

The term "short" was in use from at least the mid-nineteenth century. It is commonly understood that "short" is used because the short-seller is in a deficit position with his brokerage house. Jacob Little was known as The Great Bear of Wall Street who began shorting stocks in the United States in 1822.[6]

Short sellers were blamed for the Wall Street Crash of 1929.[7] Regulations governing short selling were implemented in the United States in 1929 and in 1940.[citation needed] Political fallout from the 1929 crash led Congress to enact a law banning short sellers from selling shares during a downtick; this was known as the uptick rule, and this was in effect until July 3, 2007 when it was removed by the Securities and Exchange Commission (SEC Release No. 34-55970).[8] President Herbert Hoover condemned short sellers and even J. Edgar Hoover said he would investigate short sellers for their role in prolonging the Depression.[citation needed] A few years later, in 1949, Alfred Winslow Jones founded a fund (that was unregulated) that bought stocks while selling other stocks short, hence hedging some of the market risk, and the hedge fund was born.[9]

Negative news, such as litigation against a company, may also entice professional traders to sell the stock short in hope of the stock price going down.

During the Dot-com bubble, shorting a start-up company could backfire since it could be taken over at a price higher than the price at which speculators shorted.[citation needed] Short-sellers were forced to cover their positions at acquisition prices, while in many cases the firm often overpaid for the start-up.[citation needed]

During the 2008 financial crisis, critics argued that investors taking large short positions in struggling financial firms like Lehman Brothers, HBOS and Morgan Stanley created instability in the stock market and placed additional downward pressure on prices. In response, a number of countries introduced restrictive regulations on short-selling in 2008 and 2009. Naked short selling is the practice of short-selling a tradable asset without first borrowing the security or ensuring that the security can be borrowed – it was this practice that was commonly restricted.[10][11] Investors argued that it was in the weakness of financial institutions, not short-selling, that drove stocks to fall.[12] In September 2008, the Securities Exchange Commission in the United States abruptly banned short sales, primarily in financial stocks, to protect companies under siege in the stock market. That ban expired several weeks later as regulators determined the ban was not stabilizing the price of stocks.[12][11]

Temporary short-selling bans were also introduced in the United Kingdom, Germany, France, Italy and other European countries in 2008 to minimal effect.[13] Australia moved to ban naked short selling entirely in September 2008.[10] Germany placed a ban on naked short selling of certain euro zone securities in 2010.[14] Spain and Italy introduced short selling bans in 2011 and again in 2012.[15] Worldwide, economic regulators seem inclined to restrict short selling to decrease potential downward price cascades. Investors continue to argue this only contributes to market inefficiency.[10]

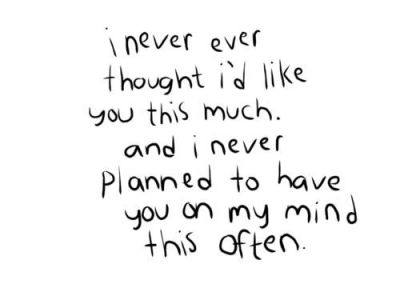

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

Short Quotes Sad Quotes About Love That Make Your Cry and Pain Tumblr For Girls that make you cry for girls for Him for Boys That Hurts Tagalog and Pain Tumblr

No comments:

Post a Comment